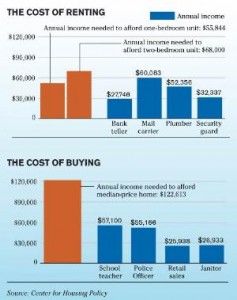

Despite the best efforts of City officials to sweep the homeless out of sight, the APEC summit in Honolulu in November shined a spotlight on Hawai’i’s cruel inequalities and vast homelessness problem. A recent Honolulu Star Advertiser article gives one of the main reasons for it: Honolulu has some of the highest housing costs in the U.S.:

Honolulu is tied for being the least affordable city for renters nationwide, with only 8 percent of middle-class jobs paying enough to afford a two-bedroom apartment.

The city also is tied for second with nearly two dozen others as least affordable for homeownership, behind only San Francisco, with just 1 of 74 service positions earning enough to afford a median-price home, according to the Washington, D.C.-based Center for Housing Policy, which released a report today on the housing market in 200 metropolitan areas.

“Hawaii faces a lot of unique challenges because it’s an island (state), it’s a tourism-driven economy and a lot of those jobs tend to be service jobs that don’t necessarily pay very well,” said Laura Williams, author of the report. “There’s just not space to develop further so that creates a lot of demand for a small supply of housing.”

The article reports that “Despite Honolulu’s median home price falling to $425,000 in the third quarter from $450,000 at the end of 2009, it still is the fourth most expensive market for homeownership.”

But local blogger/activist Doug Matsuoka, who knows the real estate market in Hawai’i, says that “it’s even worse than they say in the article. They use a figure of $450k for a house at the end of ’09. It is currently $580k.”

Instead of criminalizing the meager survival materials and possessions of the homeless left on public property, as the City Council has just done with Bill 54, why is the City not controlling rents and developing more truly affordable housing?

Yesterday, the Pacific Business News reported that military housing allowances will increase by an average of 2% in 2012:

In Hawaii, a typical E-6 with dependents based at one of the military installations on Oahu will see the BAH rise by $102 to $2,487, from the 2011 rate of $2,385.

However, many other members in Hawaii will see their rates decrease, particularly for E-1s through E-4s based on Oahu, whose BAH will drop by $156 per month to $1,860 from $2,016.

The decrease will apply only to service members who are new to locations in 2012, the Defense Department said. Service members already stationed in the area won’t see a decrease, and they will get any increases they are entitled to, the Defense Department said.

An E6 is the equivalent of a Staff Sergeant. The military housing allowance tables can be found here. According to these tables, an O1 with dependents, the equivalent of a Second Lieutenant, can get $1965/month, while an O7 with dependents, the equivalent of a one-star general, can get $3423/month. This is sufficient to pay for a mortgage. Many military personnel use their housing allowance to invest in homes while they are stationed in Hawai’i. They can sell these for a profit when they are relocated.

In this way Military housing allowances can exert inflationary pressure on the cost of housing. But where are the economic studies on the military’s impact on the cost of housing and its effects on average local families?

Just look to the line of tents on King St. near the Old Stadium Park and the ‘blue tarp cities’ in Kea’au and Ohikilolo in Wai’anae.

Meanwhile the construction and renovation of military housing has been booming. If some of these bases were reduced due to budget cuts, these homes, many of them fitted with energy efficient technologies, could become available for affordable housing. Wouldn’t that be a stimulus for local families?